Are you looking to invest in Commercial Real Estate or Traditional Real Estate but don’t have the time?

Investing in Real Estate Private Equity can be a great solution to quickly invest in all types of commercial real estate from multi-family apartment complexes to medical, office, self-storage and of course, non-commercial single-family houses while letting someone else handle all the details.

With the diversification, tax reduction and passive investing advantages, investing in Real Estate Private Equity can be quite compelling for high wage earners looking to reduce their taxable income along with high-net-worth individuals looking for an alternative to the volatility of traditional stocks and bonds investing.

So far, most of the real estate investing series discussion has been about why one would want to invest, the reasons are fairly compelling. In fact, I’m a big believer in them, with the caveat that this can be a good investment alternative for the right person. I stated above that it is quite ideal for someone that is looking to diversify away from the stock market. It is a very nice complement to an investment in stocks due to its low correlation to the market.

YouTube Video or Read Below

Stock Market Diversification and Fantastic Tax Benefits

In short, real estate can provide a fantastic alternative investment to diversify your stock and bond portfolio while reducing your taxable income. In this post, we will discuss two investment vehicles that both allow you to invest in real estate but have very different advantages and disadvantages related to taxes, liquidity and investment minimums. Depending on your situation, one might be a better alternative for you.

But first, lets start with why adding Real Estate to your investment portfolio is a good idea.

Why Add Real Estate To Your Investment Portfolio?

Adding real estate to your investment portfolio can provide several benefits, including:

- Diversification: Real estate is a unique asset class that has low correlation with other traditional asset classes, such as stocks and bonds. This means that adding real estate to your portfolio can help to diversify your investments and reduce overall portfolio risk. Generally speaking, when the stock market is falling you can rest easier knowing that your real estate portion is holding steady.

- Potential for steady income: Real estate investments can also provide investors with a steady stream of income through rental income, lease payments, or other forms of passive income. Of course, you can select dividend stocks or ETFs in your stock portfolio to have a similar impact.

- Hedge against inflation: Real estate generally serves as a great hedge against inflation, as rents and property values usually rise in line with inflation over time.

- Tax benefits: Real estate investments may offer certain tax benefits, such as deductions for mortgage interest, property taxes, and depreciation.

- Tangible asset: Real estate is a tangible asset that investors can see and touch, which can provide a sense of security and stability in their investments.

Overall, adding real estate to your investment portfolio can help to diversify your investments, provide potential for long-term appreciation, generate income, provide a hedge against inflation, offer tax benefits, and provide a tangible asset that can offer a sense of security and stability.

Real Estate Syndication vs REIT – What Are They?

Lets start with some simple definitions.

What is a Real Estate Syndication?

Real Estate Syndications or Funds are private investment opportunities that pool capital from multiple investors to acquire and manage a specific property or portfolio of properties.

The real estate syndication is typically structured as a limited partnership or limited liability company (LLC), with the sponsor or syndicator acting as the general partner or managing member. The sponsor is responsible for identifying the investment opportunity, conducting due diligence, acquiring the property, and managing the day-to-day operations of the investment.

Investors in the syndication typically receive a share of the profits generated by the investment, which may include rental income, capital appreciation, and proceeds from the sale of the property. The profits are typically distributed to the investors on a pro rata basis, based on their percentage ownership in the syndication.

If you want to find out more about Real Estate Syndications, you might check out our blog or some of our other posts where we discuss Real Estate Private Equity in more detail.

- Advantages of a Syndication

- tax advantaged

- low correlation with the stock market

- Disadvantages of a Real Estate Syndication

- not liquid

- higher minimum investment

What is a REIT?

A Real Estate Investment Trust (REIT) is a type of investment vehicle that owns and manages income-generating real estate properties. It also allows investors to pool their money together to invest in a professionally managed portfolio of real estate assets, similar to how mutual funds allow investors to pool their money together to invest in a professionally managed portfolio of stocks and bonds.

These companies are very similar to what I described above as a Real Estate Syndication or Real Estate Fund, but they must meet several requirements to qualify as a REIT.

REITs can also invest in various types of real estate assets such as office buildings, shopping malls, apartment buildings, warehouses, hotels, and other types of commercial or residential properties. They typically generate income for investors through rent or leasing income, and they must distribute at least 90% of their taxable income to shareholders in the form of dividends, making them attractive to income-seeking investors.

- Advantages of a REIT

- highly liquid

- low minimum investment

- simple to purchase through a retirement account

- Disadvantages of a REIT

- not tax advantaged

- high correlation with the stock market

Real Estate Syndication vs REIT, What’s the Difference?

You are probably thinking at this point, Real Estate Syndication vs REIT, they sound the same. And, you are somewhat correct in your thinking, they are very similar. Yet they do have some differences that are important to consider.

Ownership Structure

When investing in a REIT, you purchase shares in the company that owns the real estate assets. You don’t actively own the property.

Investing in a real estate syndication, you invest directly in a specific property (or properties). In other words, you own a certain percentage.

Ownership Winner: Real Estate Syndication

Liquidity

One of the main reasons people invest in REITs vs syndications has to do with liquidity. REITs are more liquid than a real estate syndication.

REITs are publicly traded on stock exchanges, which means that investors can buy and sell their shares at any time. In contrast, real estate syndications are private investments that are not publicly traded, and therefore lack liquidity. This can make it more difficult for investors to access their funds if they need to sell their shares quickly.

Most Private Equity Real Estate deals have a target timeline that you will know before entering the deal. Generally speaking the deals range in duration from 2-10 years with most being 3-5 years in length. This means your money is not available during this time. You just can’t get to it, so it’s important you are only investing money that you can be without.

Liquidity Winner: REIT

Investment Minimum

REITs typically have lower minimum investment requirements than real estate syndications, which can make them more accessible to a wider range of investors. This can be particularly attractive to individual investors who may not have the resources to invest directly in real estate assets.

When you invest in a REIT the experience is very similar to stock or mutual fund investments where you can buy a single share through your brokerage account, some of which can be just a few dollars.

The typical real estate fund investment minimum can vary between $50,000 – $100,000.

Even though you’ll need more capital to invest in syndications, the returns and tax benefits can be significantly higher.

Investment Minimum Winner: REIT

Tax Benefits

One of the biggest benefits of investing in a real estate syndication vs REIT has to do with taxes. When you invest directly in a property (real estate syndications included), you receive a variety of tax deductions. And one of the most beneficial one has to do with depreciation (i.e., writing off the value of an asset over time). Depreciation can help to reduce taxable income and increase after-tax returns.

Some times this tax benefit is a big enough reason for investors to invest in real estate in the first place. Oftentimes, the depreciation benefits surpass the cash flow. So, you may show a loss on paper but have positive cash flow. Those paper losses can offset your other income, like that from an your job/employer.

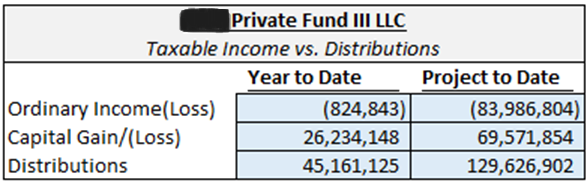

In fact, I just received our end of year summary from one of our real estate syndication deals and notice in the below image, the entity has produced over $83.9M in beneficial ordinary losses for investors while distributing over $129M.

When you invest in a REIT, because you’re investing in the company and not directly in a property, you don’t get the same depreciation benefits. While you technically still receive the benefits of depreciation, it is taken out at the company level, before you receive any dividends. Therefore, you can‘t use depreciation to offset other income.

Also an important distinction between the two, REIT income is paid as a dividend which unfortunately, is taxed as ordinary income. This can contribute to a bigger, rather than smaller, tax bill. Because real estate syndications are typically structured as partnerships or limited liability companies (LLCs), investors may be able to offset passive losses from the investment against other passive income.

Tax Benefits Winner: Syndication

Diversification

One additional huge con to REITs vs Private Equity Real Estate and privately owned real estate is that they have a very high correlation with the stock market, so when the market is down, REITs generally are as well. They are more emotionally driven investments since people tend to panic and pull their money out from all investments when the stock market is collapsing.

For me, this is the biggest reason that I stay away from REITs, the purpose of my investment in real estate is to diversify away from the stock market and investing in a REIT defeats that objective.

It is important to differentiate between public and private REITs. Public (or publicly traded) REITs are bought and sold in your brokerage account, like any stock or bond purchase. They are highly liquid but suffer from the high stock market volatility correlation that I spoke of above. Private REITs are very similar to private equity real estate investments in that they have a lock up period and are not liquid. Private REITs do benefit from having a low correlation to the stock market, but they lose the tax deferral advantages that a Private Equity Real Estate investment has.

Diversification Winner: Syndication

Tax Preparation

No tax discussion is complete without also discussing how difficult the tax forms will be at tax time. Real Estate Syndications are the clear winner for reducing taxable income, but at what expense? Do they add more complexity when it’s time to do your taxes?

If you are a DIY tax filer, the short answer is yes, investing in a real estate fund will cause your tax work to be more complicated. At tax time Private Equity Real Estate firms send a form to their investors called a K-1. If you have never looked at a K-1, it can be intimidating. The complication compounds when the deal has multiple properties scattered across multiple states.

With this said, if you are at the point where you are considering an investment in these types of deals, you probably have a good tax preparer and K-1’s are simple for them to handle. Keep in mind, if you are investing in a lot of these deals, it is quite reasonable for your tax preparer to charge you additional for the added work.

Tax Preparation Winner: REIT

Higher Return Potential

I want to be careful predicting which is better from a strictly return on investment potential, but real estate syndications may offer the potential for higher returns than REITs. There are so many factors that go into why a real estate investment has a good or even stellar return, but in general real estate funds do better.

Factors that can affect performance include the sponsor experience, the location, debt leverage terms, the type of property, the local and general economy at that moment in time, along with a whole slew of other variables. If you want to dig deeper into this topic. we cover it is detail in our real estate investing series.

Real Estate Funds are typically focused on a single property or a small portfolio of properties (usually not more than 30 properties). This allows for greater customization and optimization of the investment. Which can also result in higher cash flow and appreciation potential.

Higher Return Potential Winner: Syndication

Can adding Real Estate make your Investment Portfolio safer?

Reduce Taxes, Less Volatility?

For your FREE Personalized Assessment

How You Invest

Similar to public stock, most REITs are listed on major stock exchanges. Because of this, they’re able to be easily found and invested in. You can either invest with them directly or via mutual funds.

On the other hand, real estate syndications are a bit more difficult to find without knowing the sponsor or other passive investors. Your financial advisor should be able to help you find some good options as well. With this said, many advisors stay away from non REIT real estate investments because quite honestly, it takes a lot of time to understand and invest in these deals.

In fact, if you have an advisor that you are already working with, don’t be surprised if they bad mouth these and any “alternative” investment, merely because they don’t handle them and possibly do not understand them. I have heard every excuse in the book from traditional advisors, but at the end of the day, if you are not comfortable with the volatility that your portfolio is encountering, these can provide a great alternative to traditional stocks and bonds investing.

An additional hurdle is that many syndications are only open to accredited investors. I discuss accredited investors in our post on Disadvantages of Investing in Real Estate Private Equity.

Overall, the fees involved with syndications are often way less and increasingly more transparent than investing in a REIT.

Which Should You Invest In – Real Estate Syndication vs REIT?

REITS are generally easier to invest in. They are usually highly liquid and you can buy them from any brokerage account. But, with a REIT you lose all of the tax advantages that Private Equity Real Estate or investing directly in real estate have.

Income (or dividends) received from a REIT is treated as regular income (high tax). Whereas private equity real estate income is offset by depreciation and other generally accepted business expenses that the fund has.

In summary, for those individuals seeking passive income from a real estate investment, there are two main options:

- REITs

- Syndications

While the goal of each option is the same – to earn a return – they both have similarities and fundamental differences between them.

Investors should focus on their characteristics and choose the one that is most suitable for their own needs.

For the high-income professional with a large tax bill, the more legal tax deductions available, the better.

If you only have $1,000 to invest and want to access that money freely, then investing in REITs may be best. If you have more capital available and want direct ownership plus greater tax benefits, a real estate syndication may be a better fit.

And remember, it doesn’t have to be one or the other. You might begin with REITs and then add syndications later.

Or you might initially try both to diversify. Either way, investing in real estate, whether directly or indirectly, is forward progress.

Real Estate Syndication vs REIT. Which Do You Prefer?

Keep reading to learn more about: Investing in Real Estate Private Equity

- Why You Need Real Estate Private Equity, The Ultimate Guide

- What is Real Estate Crowdfunding? Everything You Need to Know.

- What Types of Real Estate Can You Invest In? How to Lower Risk with Real Estate

- Real Estate Asset Classes: Everything You Need To Know To Reduce Risk In Your Portfolio

- Real Estate Economic Cycles: Know When To Invest

- How to Diversify Your Real Estate Investments

- Real Estate Development Stages: You Need To Know This

- Real Estate Equity vs Debt: You Need to Know The Difference

- Real Estate Private Equity Advantages: A Need To Know Guide

- Real Estate Private Equity Disadvantages: Everything You Need To Know

- Real Estate Syndication vs REIT: How to Passively Invest in Real Estate

- Unlocking the Mystery: Pari Passu in Real Estate Investments