Investing in Real Estate Private Equity can be a great solution to quickly invest in all types of commercial real estate from multi-family apartment complexes to medical, office, self-storage and of course, non-commercial single-family houses while letting someone else handle all the details.

This post is a continuation in the series on Investing in Real Estate Private Equity, a guide to Real Estate Partnerships, Real Estate Private Equity Funds, Syndicates & Crowdfunding. In our last post, Real Estate Asset Classes, we discussed the various commercial real estate asset classes as well as advantages and disadvantage of each type. Here we are going to dig deeper into the different types of real estate and specifically how they are affected by the stages in an economic cycle.

Knowing how a real estate property will perform during each segment in the real estate economic cycle is an important consideration when adding real estate to any investment portfolio.

Risk During Each Stage of an Economic Cycle

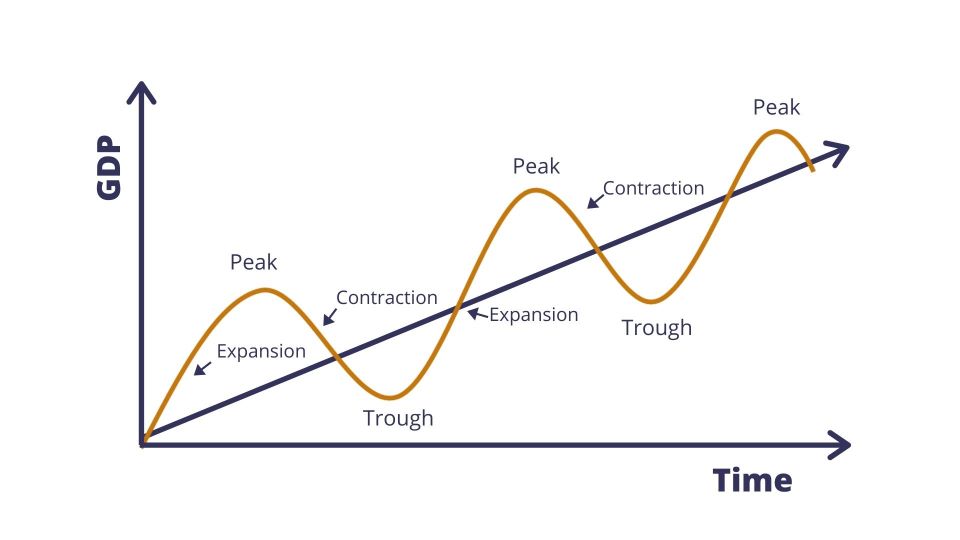

The risk associated with investing in commercial buildings can vary during different economic cycles. Economic cycles are typically characterized by periods of expansion, peak, contraction, and trough.

Here’s how the risk of investing in each class of real estate can change during each phase of the economic cycle:

Expansion Phase

Class A is the winner during the expansion phase, followed by B.

During an economic expansion, the demand for office and higher-end home space usually increases, and rental rates tend to rise. In this phase, Class A buildings tend to be the least risky, as they are in high demand and can command premium rental rates.

Class B buildings may also benefit from increased demand, while Class C buildings may see less demand due to their less desirable locations and lower-quality finishes.

In this phase, you generally have people or businesses moving up from lower-end offerings.

So Class C residents / tenants will be more likely to move to Class B and Class B will move to Class A, causing rent increases on the middle and higher-end properties

Peak Phase

Class B and C are the winners during the peak phase.

During the peak phase, economic growth starts to slow down, and vacancy rates in commercial real estate may start to rise. The peak phase can be more challenging for Class A buildings, as they are typically more expensive and may face more competition from new construction.

Class B buildings may still have stable rental income, but may also see more competition from new construction.

Class C buildings may see increased vacancy rates and a decline in rental rates, making them the riskiest class of commercial buildings during the peak phase.

Contraction Phase

Everyone loses during the contraction phase.

During the contraction phase, economic activity slows down, and demand for space decreases. This phase can be challenging for all classes of commercial buildings, with Class C buildings being the most vulnerable due to their less desirable locations and lower-quality finishes.

Class A and B buildings may still have stable rental income, but rental rates may decline.

Trough Phase

Everyone is a winner … eventually.

During the trough phase, economic activity bottoms out, and demand for space may start to pick up again. This phase can be an opportunity for investors to acquire distressed properties at lower prices.

Class A buildings may start to recover, while Class B buildings may benefit from increased demand from small businesses and startups. Class C buildings may still be the riskiest class, but can also provide opportunities for investors to add value through renovations or upgrades.

Buy Low, Sell High

Can adding Real Estate make your Investment Portfolio safer?

Reduce Taxes, Less Volatility?

For your FREE Personalized Assessment

Which Real Estate Asset Class is Best?

In summary, the risk associated with investing in commercial buildings can vary during different phases of the economic cycle. But, the bottom line is that there’s no clear winner throughout the entire economic cycle. Each class of real estate has their shining moment and times where risk is high for all.

Local vs. National Real Estate Economic Cycles

Cycles should be analyzed at the local, state and national levels taking a top down approach. In other words, if the entire country is in a recession, all real estate investment become challenging. But, if the country is doing well yet your particular state is struggling, you might consider looking into a real estate deal elsewhere. And, lastly, if locally there is a problem, maybe a military base closure, but the rest of the state and country are doing well … you might consider a hard pass on a local investment.

Real estate economic cycles are an important factor to consider when determining which investments are best for your portfolio. Most importantly, diversifying across multiple asset classes will help to reduce your overall risk.

In our next post, we dig deeper into Real Estate Diversification by looking into using location as a way to reduce risk in your portfolio.

Share your thoughts below on Real Estate Economic Cycle? Which asset class have you found performed the best?

Keep reading to learn more about: Investing in Real Estate Private Equity

- Why You Need Real Estate Private Equity, The Ultimate Guide

- What is Real Estate Crowdfunding? Everything You Need to Know.

- What Types of Real Estate Can You Invest In? How to Lower Risk with Real Estate

- Real Estate Asset Classes: Everything You Need To Know To Reduce Risk In Your Portfolio

- Real Estate Economic Cycles: Know When To Invest

- How to Diversify Your Real Estate Investments

- Real Estate Development Stages: You Need To Know This

- Real Estate Equity vs Debt: You Need to Know The Difference

- Real Estate Private Equity Advantages: A Need To Know Guide

- Real Estate Private Equity Disadvantages: Everything You Need To Know

- Real Estate Syndication vs REIT: How to Passively Invest in Real Estate

- Unlocking the Mystery: Pari Passu in Real Estate Investments