Embarking on the complex terrain of real estate private equity deals requires a keen understanding of the key principles that govern fairness and equality among investors. One such critical concept, often encountered in Real Estate Operating Agreements, is “Pari Passu” in Real Estate Investments.

In this post, we dissect the significance of “Pari Passu” within the context of real estate deals, unraveling how this principle plays a pivotal role in ensuring equitable treatment, shared profits, and transparent decision-making among limited partners.

Understanding “Pari Passu” – Beyond Latin Jargon

Navigating Real Estate Operating Agreements may make “Pari Passu” appear as a cryptic code. Fear not, astute investor! Let’s demystify this term and unveil why “Pari Passu” in real estate investments is crucial for private equity.

Pari Passu Unveiled: Equality in the Real Estate Realm

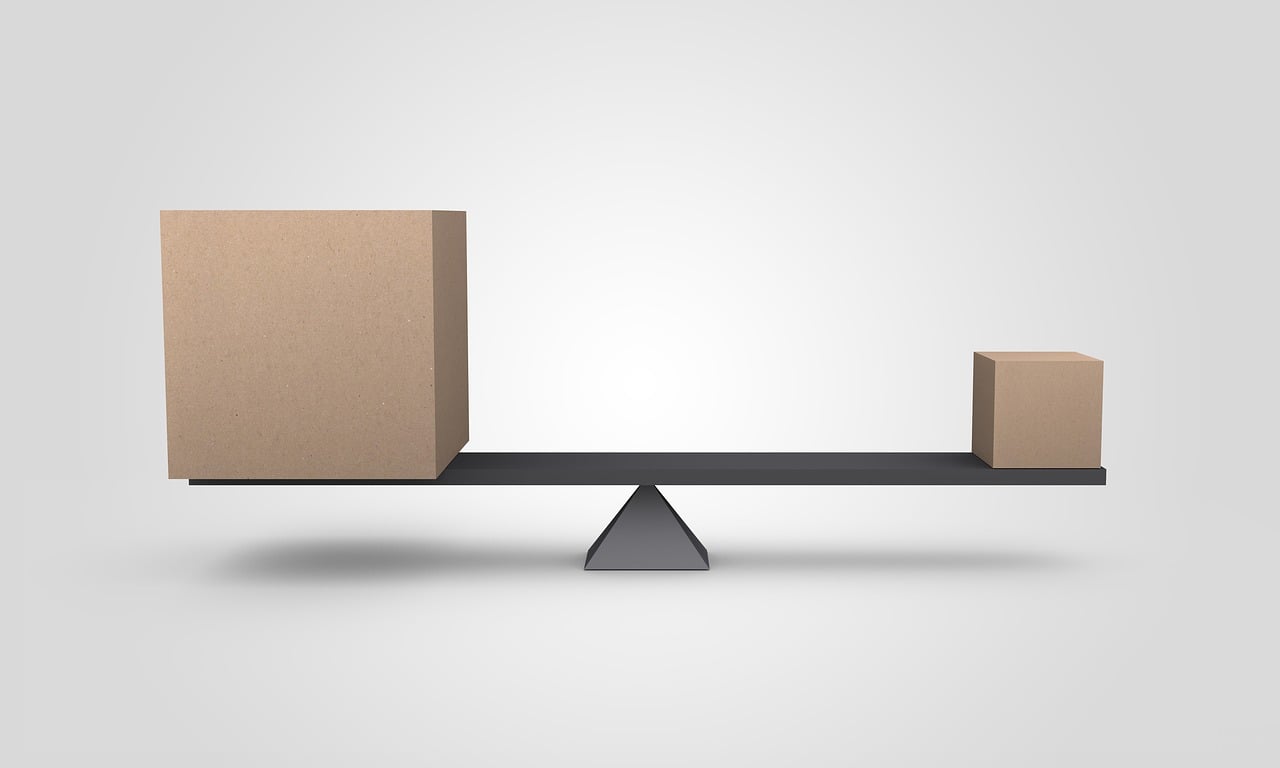

At its essence, “Pari Passu” translates to “on equal footing” in English. In real estate, it signifies a scenario where different classes of securities or investors enjoy equal rights and privileges. Picture it as the great equalizer in the intricate dance of real estate investing.

The Importance of Equal Rights in Real Estate Private Equity Deals

Before delving into “Equal Shares, Equal Cares,” let’s explore why having equal rights is crucial in real estate private equity deals. In this dynamic arena, fairness ensures a harmonious partnership and guards against potential imbalances.

Can adding Real Estate make your Investment Portfolio safer?

Reduce Taxes, Less Volatility?

For your FREE Personalized Assessment

Equal Shares, Equal Cares: The Impact of Pari Passu in Real Estate Investments

Now, let’s delve into the heart of the matter, exploring how “Pari Passu” in real estate investments orchestrates fairness and equality in the distribution of profits, the return of capital, and the democratic exercise of voting power among limited partners.

1. Profit-sharing Precision

When the real estate venture turns a profit, limited partners are in for a share. “Pari Passu” ensures that these profits are distributed fairly among partners based on their ownership percentage. No favoritism here—everyone gets their proportionate piece of the financial pie.

2. Capital’s Grand Exit

As the investment undergoes liquidation or sale, limited partners eagerly await the return of their capital contributions. Thanks to the principles of “Pari Passu” in real estate investments, each partner receives their due, irrespective of the size of their investment. It’s like a financial distribution where everyone leaves with their pockets equally filled.

3. Votes for All, Regardless of Size

Limited partners often wield voting power in specific real estate matters. “Pari Passu” in real estate investments ensures that each partner’s vote carries equal weight. It’s a democratic process where your voting power isn’t determined by the size of your investment. One partner, one vote—fair and square.

Why “Pari Passu in Real Estate Investments” Matters

Understanding and embracing “Pari Passu” is akin to having a shared understanding in the real estate investing landscape. It fosters trust, transparency, and a sense of equality among partners. As an investor, it’s about more than just returns; it’s about navigating the real estate journey on an equal playing field with your peers.

Key Insight: Pari Passu Ensures Equity in Real Estate Ventures

So, the next time you encounter “Pari Passu” in a Real Estate Operating Agreement, don’t be alarmed. Embrace it. It’s the assurance that in this complex real estate journey, everyone is walking the same path, side by side, Pari Passu.

Unlock the doors to equal opportunities—Pari Passu is your key!

Want to learn more, check out our Ultimate Guide on Real Estate Private Equity to learn all the ins and outs of investing in Real Estate Syndication.

Keep reading to learn more about: Investing in Real Estate Private Equity

- Why You Need Real Estate Private Equity, The Ultimate Guide

- What is Real Estate Crowdfunding? Everything You Need to Know.

- What Types of Real Estate Can You Invest In? How to Lower Risk with Real Estate

- Real Estate Asset Classes: Everything You Need To Know To Reduce Risk In Your Portfolio

- Real Estate Economic Cycles: Know When To Invest

- How to Diversify Your Real Estate Investments

- Real Estate Development Stages: You Need To Know This

- Real Estate Equity vs Debt: You Need to Know The Difference

- Real Estate Private Equity Advantages: A Need To Know Guide

- Real Estate Private Equity Disadvantages: Everything You Need To Know

- Real Estate Syndication vs REIT: How to Passively Invest in Real Estate

- Unlocking the Mystery: Pari Passu in Real Estate Investments