I’m going to show you how to make $10,000,000. Yes, that’s right 10 MILLION. This isn’t a joke … I am very serious. In fact, I’m going to be so bold as to say, if you follow my advice I want a ‘finder’s fee’ for showing you how to make this money. So … I want you to send me a check for 10% … $1,000,000, and you keep the other $9,000,000.

Education is golden. Ignorance is not …

Ok, you ready for my secret that will make you millions?? Joking aside … this is a very serious topic that Wall Street AND YOUR INVESTMENT ADVISOR doesn’t want you to see. In fact, I’m sure they will balk at my analysis, but this is very simple math that you can do on your computer within 10 minutes.

Here goes … FIRE YOUR FINANCIAL PLANNER!

Oh … and if he is an Investment Advisor (IA), Certified Financial Planner (CFP), Financial Advisor (FA) or Broker do the same!

Your Financial Advisor Fees Are Eating Up Your Profits

In fact, when I joked earlier about me taking a finder’s fee … that is exactly what most FP’s are doing.

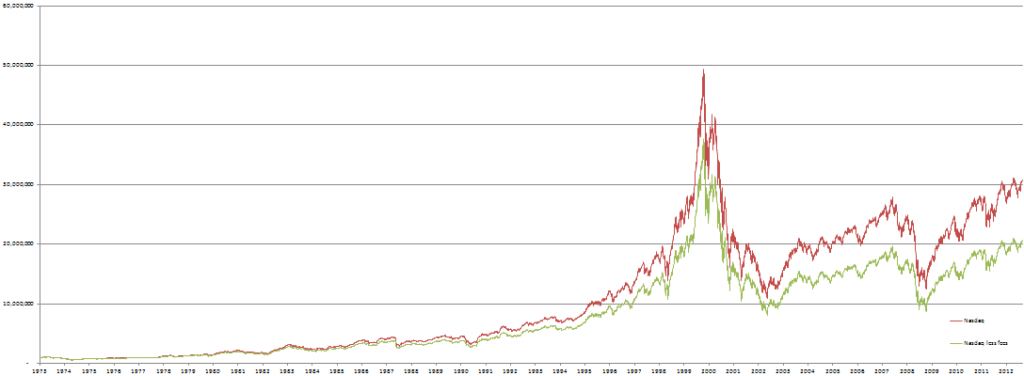

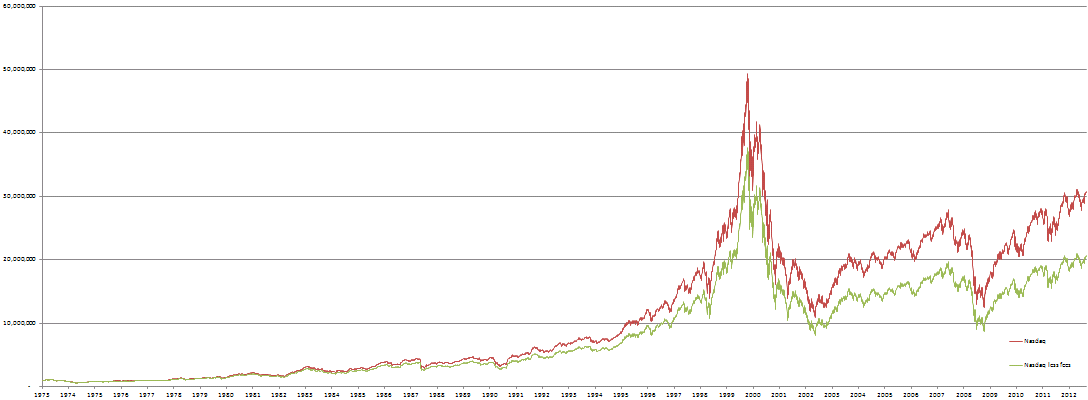

The chart below is using real historical numbers. If you had put $1 million into the Nasdaq in 1973 and just let it sit (Buy and Hold) for 40 years, you would have ended up with over $30 million.

If you had an advisor do the same, you would have shaved $10 million off of your performance. Your advisor would have been paid $10 million or 1/3 of your profit for his wonderful buy and hold advise.

But What a Minute, Isn’t RESNN Investments a Registered Investment Advisor??

Why yes we are.

So should you fire us??

I will elaborate on this later, but it is important to note that the majority of Financial Advisors believe in a buy and hold approach, they believe that they can NOT outperform the market consistently over time and therefore they do exactly what the above chart shows.

But there are some advisors that stand out from the crowd and seriously outperform. They provide value to your portfolio and AFTER their fees are paid you end up with substantially more than a buy and hold approach. And there are another small group of advisors that are finding alternative investments and ways to truly diversify your portfolio, substantially lowering the risk you are taking on vs a Buy and Hold approach.

These advisors are hard to find, because it takes serious work to pull this off. But they are out there, and later on I will show you how to find them. (self plug … RESNN is one of them) 🙂

First Experience With a Financial Advisor

I want to share my very first experience with a financial advisor which taught me a valuable, albeit expensive lesson about how Wall Street operates.

I was in my mid 20’s and had saved up what I thought at the time was a lot of money. It was roughly $100,000.00. I felt it was time for a professional to take that money and turn it into something substantial.

I talked with my mom as to what I should do and she suggested I meet with her Financial Planner. She spoke highly of him and how he can not only help me grow my little nest egg into something substantial, but also to protect it over time.

Heading to his office, I remember that beautifully sunny day so well. I had the windows rolled down in my Honda and well … I could see the future as I drove. I knew that next year I would be driving back to see my new financial advisor in a Mercedes. And maybe if we was as good as my mom said he was (my mom by the way has subsequently let him go), I would maybe even be driving back in a few years in a new Ferrari!

I know this all sounds silly in hindsight, but we’ve all felt this irrational exuberance when starting out in the market. We’ve all seen the movies with the Gordon Gekko types being chauffeured around New York and taking private jets … “This is your wake up Buddy”. So hey, you can’t blame the wet behind the ears investors for thinking they will be the next one in line to the pile of money just waiting for them.

We all know that there literally is no better way to grow your money than investing in the stock market. Real estate and private equity investing come very close and are even ahead some years (although there is no liquidity with these types of investments).

All That Glitters Ain’t Always Gold …

I remember walking into the lobby of this high rise. Boy, it was impressive at that time in my life with the large ceilings and granite from floor to ceiling. His office with leather everything. His desk looked like something I would’ve seen on a tour of Versailles. I also remember shaking his hand and admiring his suit. He was impeccably dressed.

As we talked, he would occasionally flick through a few screens on his multi-monitor computer (remember this was the 90’s, this was very cutting edge). I thought, if anyone was going to get me in that Ferrari … it was going to be this guy!

Although he made it clear that normally he doesn’t handle clients with as little net worth as I (thanks a lot!), he was graciously going to do my mom a favor (what a great guy!) and take me on as a ‘client’. When I left I felt on top of the world. We came up with a plan to properly “diversify” with an appropriate risk/reward level that I was comfortable with.

Diversify With An Appropriate Risk / Reward Level

Well, the reality is when he said “diversify” … what he really meant was to keep some of the funds in my pocket, and ‘diversify’ some of my funds into his pocket.

I didn’t realize this for about a week, when I decided with my new knowledge of investing that I would go to Morningstar.com to find out what amazing new investment products my “advisor” had put in me to turn my $100,000 into millions.

I learned a lot on that Saturday afternoon. The first thing I learned was that of the 6 mutual funds he put me in, all of them severely under-performed the market averages. I also quickly saw that there were a few thousand (no joke) mutual funds that performed better over the past 1, 3 and 5 years! What the?!?!?!?

Valuable Lesson #1

Remember that brokers, advisors, financial planners need to get paid.

I know it was quite ignorant on my part, but I guess I never really pondered how they got paid. I guess I assumed they were like bankers and there was not an issue of trust.

So … why the heck did he pick under-performing funds??

Well, remember my broker needed to find a way to get paid, so he picked from a small universe of funds that collect (from the customer) a commission (called a load) and pay it to the broker. He put me all in funds that charge a 5.75% load (or sales charge) which means that on day 1, my $100,000.00 immediately became $94,250.00 …

‘Look-y there’ My Broker Was Right, I Was Now Diversified!

This was it … my first experience with Wall Street … my first hour with a ‘professional’ and I was already down $5,750.00.

In all actuality this was a pivotal point in my future career and one that I am truly thankful of. I learned more in that hour than most learn over their entire life. You can truly outperform in Wall Street, but you have to know how to play the game and you can’t always trust the professionals.

Accepting defeat and humbled, the next week I went down to my mom’s advisor’s opulent office one last time to close my account. I remember half listening to him try to talk me out of liquidating my account, I remember him trying to justify sticking around since I was already suckered. Well … he said it differently … “you’ve already paid the fees, now is the worst time to sell.”

This schmuck put me in crappy investments, charged me a boat load to do so and had the nerve to try and sucker me to stick around!

I have a mantra that I believe strongly in, which I didn’t learn until much later in life, which applies to the market as well as life in general … “It’s ok to be wrong, it’s not ok to stay wrong”.

In hindsight, this was a very inexpensive lesson for me, time to lick my wounds and move on.

In a future post, I will continue this discussion on Financial Planners and Investment Advisors, but know for now … that unless this person is providing a substantial value to you … you should fire them and save the $10 million.

April 1 @ 3:36 pm

Can you show me how to? My name is Anthony Davis from Lorain Ohio and my email is [email protected]. you can also reach me at 2165435077.